Human Resources News Stories Pulled from Leading Newswires

News Sourced for HR Professionals

Naomi Hoshino Horii's Holding Light Productions Champions Healing and Empowerment in HR and Talent Management

Naomi Hoshino Horii's innovative approaches through Holding Light Productions and The Love Academy offer transformative tools for personal and …

July 11, 2025

Source

AI's Impact on Employment: A Nuanced Perspective for HR Professionals

This article explores the complex effects of AI on the job market, highlighting the debate between job displacement and the creation of new …

July 10, 2025

Source

John Adams' Leadership at Kasm Technologies Enhances Federal Sector Solutions

John Adams' extensive experience in technology and military leadership is driving Kasm Technologies' success in delivering mission-critical solutions …

July 10, 2025

Source

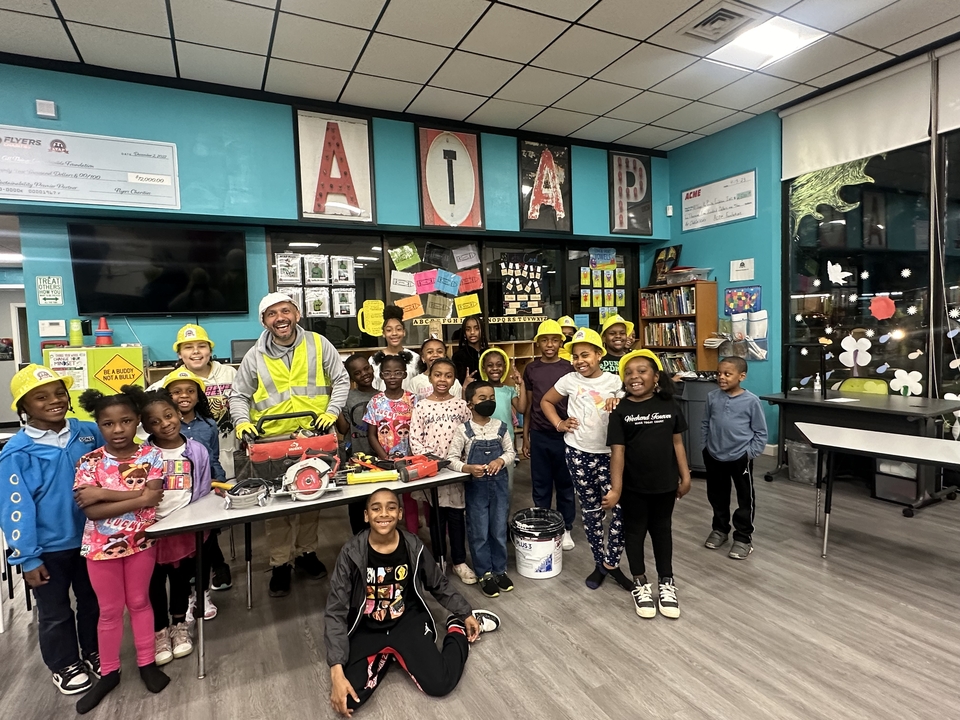

Chloe Worthy's Club Cool Kids: A Model for Youth Empowerment and Leadership

Chloe Worthy's creation of Club Cool Kids showcases the profound impact of youth-led initiatives on community engagement and leadership development.

July 10, 2025

Source

Lift HCM to Showcase Integrated Human Capital Management Solutions on National Television

Lift HCM's upcoming feature on 'Inside the Blueprint' highlights the significance of integrated HCM solutions in streamlining HR processes and …

July 10, 2025

Source

AI Revolutionizes Coaching and Mentorship in Professional Development

The integration of artificial intelligence into coaching and mentorship is transforming career development by offering personalized guidance and skill …

July 10, 2025

Source

NPHub's Innovative Platform Addresses Critical Nurse Practitioner Shortage

NPHub is revolutionizing the nurse practitioner career pathway by connecting students with clinical opportunities, supported by a $20 million …

July 10, 2025

Source

Insurance Canopy Expands Coverage to Include Workers’ Compensation for Cleaning and Landscaping Businesses

Insurance Canopy's new workers' compensation policy offers small businesses in the cleaning and landscaping sectors a fast, affordable way to protect …

July 9, 2025

Source

Intellum and SEI Forge Strategic Partnership to Enhance Learning Management Solutions

Intellum and SEI's partnership integrates consulting services with learning platforms to deliver impactful, business growth-oriented learning …

July 9, 2025

Source

Anthony Silard's 'Love and Suffering' Offers New Insights into Emotional Resilience and Leadership

Anthony Silard's latest book, 'Love and Suffering', delves into the complex relationship between love and suffering, offering readers a guide to …

July 9, 2025

Source

Better Life Home Cleaning Recognized as a Top Workplace in St. Louis for Third Consecutive Year

Better Life Home Cleaning's third consecutive Top Workplace award underscores its commitment to a positive workplace culture, as validated by employee …

July 9, 2025

Source

Emergn Appoints Jaime Ruhl as Chief Revenue Officer to Drive Global Growth

Emergn's strategic appointment of Jaime Ruhl as CRO aims to accelerate global expansion and enhance delivery of its VFQ philosophy to organizations …

July 8, 2025

Source

Universal Parking Recognized as 2025 Top Workplaces Culture Excellence Winner in Multiple Categories

Universal Parking's dedication to fostering a supportive and empowering work environment has earned it recognition as a 2025 Top Workplaces Culture …

July 8, 2025

Source

Franchise Brands Urged to Prioritize Engagement Over Sales on Social Media

David Hennessey of CertaPro Painters emphasizes the importance of authentic engagement and local content for franchise brands on social media to …

July 8, 2025

Source

ADISA Appoints Jade Miller as First CEO to Lead Strategic Growth and Innovation

ADISA names Jade Miller as its first CEO, marking a strategic move towards growth and innovation in the alternative investments industry.

July 8, 2025

Source

Southeast Investor Conference to Spotlight Early-Stage Investing and Innovation

The upcoming Southeast Investor Conference aims to address the challenges of early-stage investing and foster regional investment activity through …

July 7, 2025

Source

GEODIS Appoints Laura Ritchey as President & CEO of Americas Region to Strengthen U.S. Market Presence

GEODIS names Laura Ritchey as President & CEO of its Americas region, aiming to bolster its position in the U.S. logistics market with her extensive …

July 7, 2025

Source

NanoGraf Announces Leadership Transition to Accelerate Commercial Growth

NanoGraf appoints Thomas Redd as new CEO to drive commercial execution and expansion, marking a strategic shift from its R&D focus under outgoing CEO …

July 7, 2025

Source

Parker Burke Appointed President of Fluke Corporation and Fortive’s Connected Reliability Group

Parker Burke's appointment as President of Fluke Corporation and Fortive’s Connected Reliability Group signals a strategic push towards AI-driven …

July 7, 2025

Source